Capital, Not Cash: The Systematic Dismantling of the Regional Family Firm

There is a particular brand of political theatre that involves setting a house on fire and then expecting a standing ovation for handing the owner a bucket of water. Why the Government’s strategic retreat on its planned IHT raid is merely a temporary reprieve for the South West’s economic engine.

7 January 2026

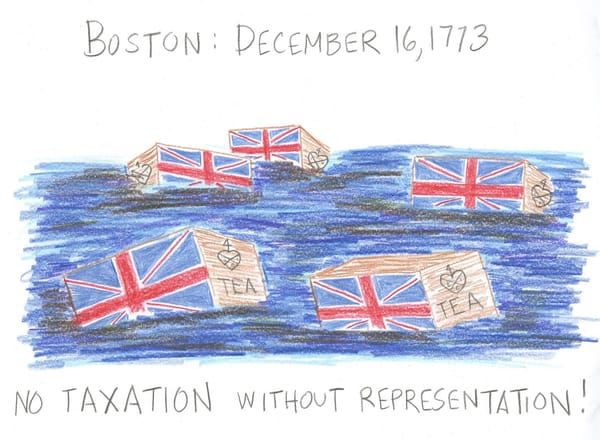

There's a particular brand of political theatre that involves setting a house on fire and then expecting a standing ovation for handing the owner a bucket of water. Such was the atmosphere just before Christmas, when the Government announced a strategic retreat on its planned raid of Agricultural and Business Property Reliefs. By raising the tax-free threshold from £1 million to £2.5 million, the Treasury clearly hoped to dampen the fires of a rural and industrial revolt that had been smouldering since Rachel from Accounts started her kite-flying exercise in the Autumn.

In the tea rooms of Whitehall, £2.5 million likely appears a generous sum - the sort of figure associated with the comfortably retired. In the context of a modern, capital-intensive South West business however, it’s a paltry amount that leaches into the soil with remarkable speed. Whether multi-generational farm in the Mendips or an aerospace workshop in Gloucestershire, Rachel’s ‘concession’ is less a 'reprieve', and more a 'stay of execution'.

The Myth of the Landed Gentry

The fundamental flaw in the Treasury’s logic is the refusal to distinguish between 'wealth' and ‘capital’. By ‘refusal to distinguish’, I of course mean ‘ignorance of the difference’. For the South West’s farming community, land is not a liquid asset that is traded - it’s the DNA of production. With regional land values driven upwards by environmental targets and 'amenity’ buyers, a 200-acre holding can easily find itself on the wrong side of the new threshold before a single tractor has been valued.

But the ‘farmer-only’ lens of the national media misses a deeper, more damaging, reality. This tax change is a direct assault on the private family-owned businesses that form the industrial spine of our region. These are the ‘hidden champions’ of the South West - the Cornish maritime tech pioneers, or the Dorset engineering shops, that provide the ‘high growth’ potential Rachel keeps banging on about (because if she repeats it enough, it will come true).

The End of the Family Firm

Business Property Relief was never an ‘inheritance tax loophole’ for the rich. It was a mechanism to ensure that the death of a founder didn't result in the death of the firm. By imposing a 20% effective tax rate on values exceeding the £2.5 million cap, this Labour Government is effectively forcing a liquidity crisis on every successful family business in the West Country.

For an engineering firm with £10 million in specialised plant and property, the resulting tax bill will not be settled out of petty cash. It will be settled by selling off assets, halting investment, selling the entire concern to a private equity group, or worse, to a vulture fund, at a knock-down price. Whitehall speaks of an ‘industrial strategy’ with one breath, while with the other, it creates a tax regime that makes local longevity a fiscal impossibility. Don't you just wish they'd just get out of the way? If ever there was an argument for smaller-government, is it not this?

The Seven-Year Gauntlet

Perhaps most insidious is the macabre ‘anti-forestalling’ rule. By backdating the seven-year survival requirement for gifts made since October 2024, the Government has turned succession planning into a high-stakes gamble on the donor’s mortality. If a Gloucestershire factory owner hands over the reins to his children today, he must remain in robust health until 2031 to avoid the state seizing a fifth of his life's work. It's an extraordinary intrusion of the Treasury into the natural cycle of generational renewal. While other countries recognise the importance of generational wealth-building, RFA and 2KT just see piggy-banks to be raided.

A Failure of Vision

This is not merely about the unintended consequences of policy made by a hopelessly-hopelessly-hopelessly, out-of-her-depth, underqualified, mendacious, floundering (did I say, hopeless) Chancellor. It's about a fundamental misunderstanding of the South West economy. Our region functions not on the whims of the FTSE 100, but on the grit and long-termism of family-owned capital.

Raising the threshold to £2.5 million is a tactical bribe designed to detach the smallest farmers from the wider business community. And it does nothing to protect the 'substantial’ firms that actually drive our regional productivity. As we move into 2026, the South West’s business leaders should see this concession for what it is: a poison pill wrapped in holiday tinsel.

Stay Wobbly. Watch the hedgerows.